Unsure When to Buy or Sell ? Interpreting industry Signals

Are you constantly second-guessing your investment decisions ? Do you find yourself wondering if it’s the right time to buy or sell a particular asset ? Understanding and interpreting industry Signals is crucial for making informed decisions and maximizing your investment returns.

Many investors struggle with industry timing , often making emotional decisions based on fear or greed. This can lead to missed opportunities and significant financial losses. The key is to develop a disciplined approach based on a thorough understanding of industry dynamics.

This article aims to equip you with the knowledge and tools necessary to interpret industry Signals effectively. We’ll explore various indicators, analytical techniques, and strategies to help you make more confident and profitable investment decisions. We will begin by defining the basic of industry signals and then will break down a few ways in which you can read them. After reading this article, you will feel more confident on how you invest.

Understanding the Basics of industry Signals

Related Post : Analyzing Commercial Property Subsectors: Retail, Office, Industrial – A Deep Dive

What are industry Signals ?

industry Signals are indicators , data points, and patterns that offer insights into the current and future direction of financial industrys. These signals can scope from economic data releases to technical chart patterns and investor sentiment indicators. Understanding these signals can help investors gauge industry trends, assess risk, and make informed decisions about when to enter or exit positions. industry signals aren’t a crystal ball , they are a tool that helps you make better decisions. Learning how to interpret those signals is very crucial to the longevity of investing.

Types of industry Signals:

There are two basic types of industry Signals you can focus on.

- Economic Indicators: These include data releases such as GDP growth, inflation rates, employment figures, and consumer spending. Economic indicators offer insights into the overall health of the economy and can influence industry sentiment.

- Technical Indicators: These are derived from price and volume data and include tools like moving averages, Relative Strength Index (RSI), and MACD. Technical indicators help determine trends, momentum, and potential reversal points.

- Sentiment Indicators: These gauge investor sentiment and include measures like the VIX (Volatility Index), put/call ratios, and surveys of investor confidence. Sentiment indicators can offer insights into industry psychology and potential extremes.

Why are industry Signals crucial?

- Informed Decision-Making: industry Signals offer valuable information that can help investors make more informed decisions, reducing the likelihood of emotional or impulsive actions.

- Risk Management: By understanding industry Signals , investors can better assess and manage risk, adjusting their positions and strategies accordingly.

- chance Identification: industry Signals can help determine potential investment opportunities , allowing investors to capitalize on emerging trends and industry inefficiencies.

Consider , for example, the impact of a surprise interest rate hike by the Federal Reserve. This economic indicator can send shockwaves through the industry, leading to a sell-off in stocks and a rally in bonds. Investors who understand the implications of this signal can adjust their portfolios to mitigate risk and potentially profit from the industry reaction.

Utilizing Technical examination to Interpret industry Signals

Introduction to Technical examination

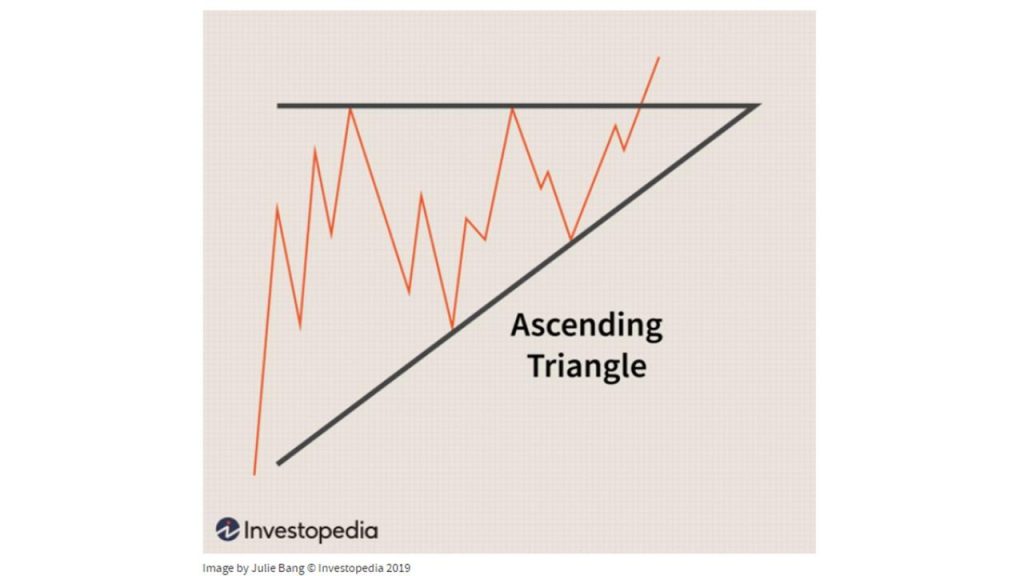

Technical examination is a method of evaluating investments by analyzing past industry data, such as price and volume. The core assumption of technical examination is that all known information is reflected in the price of an asset. Technical analysts use charts and various indicators to determine patterns and trends that can help predict future price movements. Technical examination is crucial to understand industry signals. Without it , you are basically investing blindly and not focusing on the data in front of you.

Key Technical Indicators:

- Moving Averages: Moving averages smooth out price data to determine trends. Common types include simple moving averages (SMA) and exponential moving averages (EMA). For example, a 50-day moving average can help determine the short-term trend, while a 200-day moving average can indicate the long-term trend.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It scopes from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions. RSI can help in determining when to buy or sell your assets.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD line is calculated by subtracting the 26-day EMA from the 12-day EMA. A signal line (typically a 9-day EMA of the MACD line) is then plotted on top of the MACD line, functioning as a trigger for buy and sell signals.

Practical Application of Technical examination

Let’s consider a hypothetical scenario: Suppose you are analyzing the stock of a technology company and notice that the price has been consistently trading above its 200-day moving average. This suggests a long-term uptrend. Additionally, you observe that the RSI is approaching 70 , indicating that the stock may be overbought. Combining these signals, you might decide to wait for a pullback before initiating a long position, or consider taking profits if you already hold the stock.

For example , during the COVID-19 pandemic, many tech stocks experienced significant price boosts. Technical analysts using moving averages and RSI could have identified overbought conditions and advised investors to take profits before subsequent corrections. This would have helped investors preserve capital and avoid losses. Technical examination is crucial and can help investors see when they can make the right decisions with their investments.

Fundamental examination for Interpreting industry Signals

The Essence of Fundamental examination

Fundamental examination involves evaluating the intrinsic value of an asset by examining economic, financial, and qualitative factors. Unlike technical examination, which focuses on price and volume data, fundamental examination delves into the underlying factors that drive an asset’s value. This approach is often used by long-term investors who seek to determine undervalued assets with the potential for long-term growth. Without this, industry signals can be hard to read and decipher to make the right decision with your assets.

Key Fundamental Indicators:

- Financial Statements: Analyzing a company’s financial statements, including the income statement, balance sheet, and cash flow statement, is crucial for assessing its financial health. Key metrics include revenue growth, profit margins, debt levels, and cash flow generation.

- Economic Indicators: Macroeconomic data, such as GDP growth, inflation rates, and interest rates, can significantly impact the performance of companies and industries. For example, rising interest rates can boost borrowing costs and reduce corporate profitability.

- Industry examination: Understanding the dynamics of the industry in which a company operates is essential. Factors such as industry size, growth rate, rival landscape, and regulatory environment can influence a company’s prospects.

Case Study: Value Investing with Warren Buffett

Warren Buffett, one of the most achievementful investors of all time, is a proponent of fundamental examination and value investing. Buffett looks for companies with strong fundamentals, such as consistent profitability, a durable rival benefit, and a capable management team. He then assesses whether the stock is trading below its intrinsic value, providing a margin of safety. He is a believer of knowing your industry signals before investing in anything.

For example, Buffett’s investment in Coca-Cola is a classic example of value investing. He recognized that Coca-Cola had a strong brand, a loyal customer base, and consistent earnings. Despite short-term industry fluctuations, Buffett held onto his investment for the long term, benefiting from the company’s continued achievement. Buffett’s approach underscores the importance of understanding the underlying value of an asset and avoiding the pitfalls of short-term industry speculation.

Sentiment examination and industry Psychology

Understanding industry Sentiment

industry sentiment refers to the overall attitude of investors toward the industry or a specific security. It reflects the collective emotion or feeling of all industry participants, which can scope from extreme optimism (greed) to extreme pessimism (fear). Understanding industry sentiment is crucial because it can significantly influence price movements, often leading to irrational behavior and industry inefficiencies.

Indicators of industry Sentiment:

- VIX (Volatility Index): The VIX, often referred to as the “fear gauge,” measures the industry’s expectation of volatility over the next 30 days. A high VIX indicates boostd fear and uncertainty, while a low VIX suggests complacency.

- Put/Call Ratios: These ratios compare the volume of put options (bets that the price will fall) to call options (bets that the price will rise). A high put/call ratio suggests bearish sentiment, while a low ratio indicates bullish sentiment.

- Investor Surveys: Surveys conducted by organizations like the American Association of Individual Investors (AAII) can offer insights into investor sentiment. These surveys ask investors whether they are bullish, bearish, or neutral on the industry.

How Sentiment Impacts industry Behavior

industry sentiment can drive price movements in ways that are not always rational. During periods of extreme optimism, investors may bid up prices to unsustainable levels, creating asset bubbles. Conversely, during periods of extreme pessimism, investors may panic and sell off assets, driving prices below their intrinsic value. These fluctuations in sentiment can create opportunities for savvy investors who can determine and capitalize on industry inefficiencies.

Consider the dot-com bubble of the late 1990s. Investor sentiment was extremely bullish on internet stocks, leading to massive overvaluation. When the bubble burst, many investors lost significant amounts of money as prices crashed. Understanding sentiment indicators could have helped investors recognize the unsustainable nature of the bubble and avoid significant losses.

Combining varied Types of industry Signals

The Power of Convergence

While each type of industry signal (technical , fundamental, and sentiment) can offer valuable insights on its own, combining them can lead to more robust and reliable investment decisions. The idea of convergence involves looking for multiple signals that align to confirm a particular trend or pattern. When varied types of signals point in the same direction, the conviction in the investment thesis boosts. Utilizing multiple industry signals can help you make the right decision with your investments.

Examples of Combining Signals:

- Technical and Fundamental: Suppose you are analyzing a company and find that its stock is trading above its 200-day moving average (a bullish technical signal). Simultaneously, you discover that the company has strong earnings growth and a high return on equity (positive fundamental signals). This convergence of technical and fundamental signals could offer a strong buy signal.

- Technical and Sentiment: Imagine that a stock has been in a downtrend, but the RSI is approaching oversold levels (a bullish technical signal). At the same time, the put/call ratio is high, indicating bearish sentiment (a contrarian bullish signal). This combination of signals could suggest that the stock is poised for a reversal.

- Fundamental and Sentiment: Consider a scenario where a company announces strong earnings outcomes (a positive fundamental signal), but the industry reacts negatively due to broader economic concerns (negative sentiment). This divergence between fundamentals and sentiment could create an chance to buy the stock at a discount.

Case Study: The 2008 Financial Crisis

The 2008 financial crisis offers a compelling example of the importance of combining varied types of industry signals. Leading up to the crisis, there were several warning signs, including:

- Technical: Housing prices had been rising rapidly, creating a bubble.

- Fundamental: Mortgage-backed securities were becoming increasingly complex and risky.

- Sentiment: Investor complacency and excessive risk-taking were prevalent.

Investors who combined these signals could have recognized the looming crisis and taken steps to protect their portfolios. However, many investors ignored these warnings, leading to devastating losses. This highlights the importance of a holistic approach to industry examination and the need to consider multiple perspectives.

FAQ

Q1: What are the most reliable industry Signals for beginners ?

For beginners, focusing on a few key indicators can be helpful. Start with economic indicators like GDP growth and inflation rates to understand the overall economic climate. Then, explore basic technical indicators like moving averages and RSI. These tools are relatively easy to understand and can offer valuable insights without overwhelming you. Remember to combine these signals with a basic understanding of fundamental examination, such as reviewing a company’s revenue growth and profitability. By starting with a focused approach, you can gradually build your understanding and confidence in interpreting industry signals.

Q2: How often should I check industry Signals to make informed investment decisions ?

The frequency of checking industry signals depends on your investment style and time horizon. For long-term investors, monitoring key economic indicators and company fundamentals on a quarterly basis may be sufficient. Short-term traders, however, may need to check industry signals multiple times a day to capitalize on short-term price movements. Regardless of your investment style, it’s essential to avoid overreacting to short-term noise and focus on the underlying trends and patterns. Regular, but not obsessive, monitoring is the key to making informed decisions.

In conclusion , effectively interpreting industry signals is paramount for making informed decisions about when to buy or sell assets. By understanding key indicators, utilizing technical and fundamental examination, and remaining disciplined, investors can navigate industry volatility with greater confidence. Remember that achievementful investing requires continuous learning and adaptation to changing industry conditions. Don’t hesitate to consult with a financial advisor to tailor your strategies to your specific objectives and risk tolerance. Are you ready to take the next step in mastering industry timing and maximizing your investment returns ? Start by implementing these strategies today!